Calculate Value at Risk in R

Normal distribution Theres a better in a statistical sense version later but here is a simple approach. The historical method is the simplest method for calculating Value at Risk.

Linear Regression With R On Iq For Gini And Linguistic Diversity Linear Regression Regression Linguistics

Fill in dnorm to compute the density of a N μ σ.

. In this case we say that we are calculating VaR with 5 confidence. Using the spreadsheets statistical functions calculate the mean and standard deviation of the daily percentage returns. I have done the following- x- matrix 140 ncol 4 xapp - applyx 2 quantile probs c010205 It gives me the following output-.

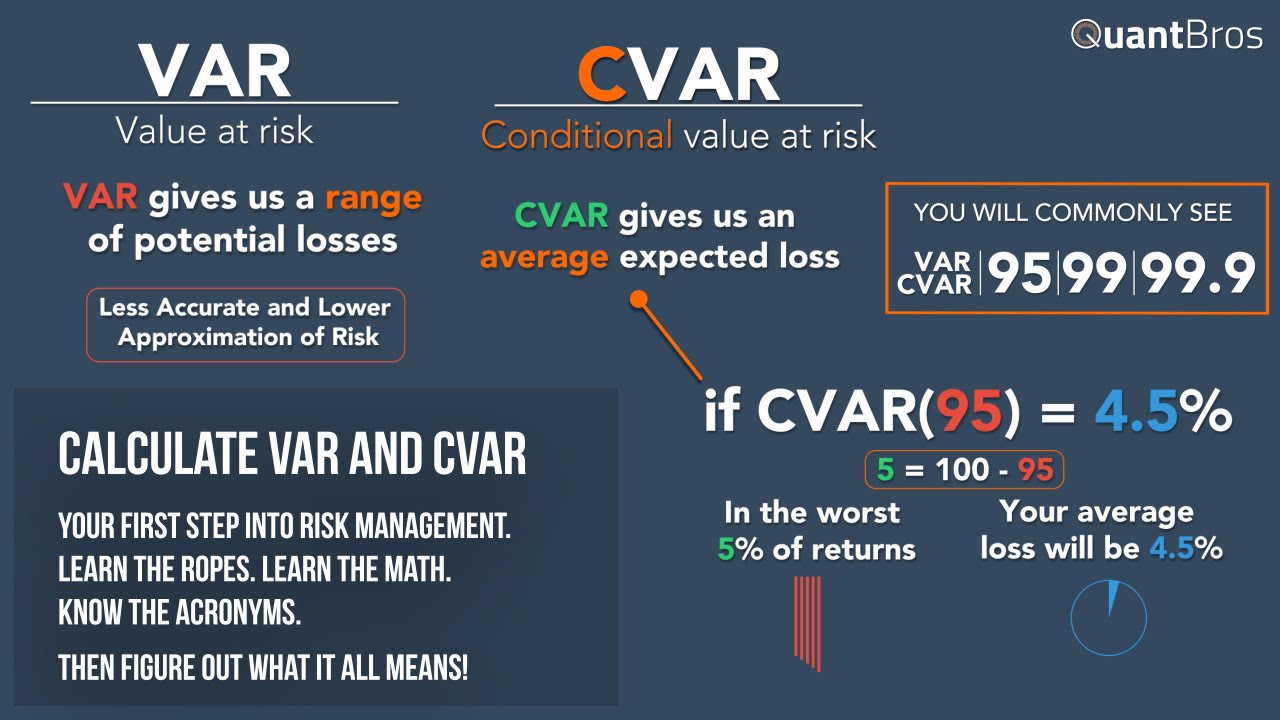

Calculate various Value at Risk VaR measures in R. So the Value at Risk is 330000 and the Expected Shortfall is 470000. The purpose of the formula is to calculate.

Value SD z-score 956735 004356141 128 53346 Meaning we could be. Preliminary Definitions For a given value-at-risk metric measure time in unitsdays weeks. -Parametric VaR -Historical VaR -Monte Carlo VaR Lets see each of them.

Up to 25 cash back Instructions 100 XP Fill in seq to make a sequence of 100 x-values going from 4 σ to 4 σ and assign to xvals. This course teaches you how to calculate the return of a portfolio of securities as well as quantify the market risk of that portfolio an important skill for. Financial Risk Management with R.

The PVaR formula is really straight forward especially with only one stock in our portfolio. There are at least three ways of calculating VaR. Value at Risk vm vi vi - 1 M is the number of days from which historical data is taken and v i is the number of variables on day i.

Calculates Value-at-RiskVaR for univariate component and marginal cases using a variety of analytical methods. The Value at Risk is calculated from the inverse of. The task of a value-at-risk measure is to calculate such a quantile.

For a time series of returns rt r t V aRt V a R t would be such that P rt. I am trying to find the value at risk. Market data for the last 250 days is taken to calculate the percentage change for each risk factor on.

VaR can be defined as loss in market value of an asset over a given time period that is exceeded with a probability θ θ.

Present Value Pmp Exam How To Memorize Things Pmp Exam Prep

How To Calculate Interest Compounding For Exponential Growth Accounting Principles Finance Money Quotes

Varioety Of Demo Notebooks Done With R Python And F Jamesigoe Azurenotebooks Master Github Financial

Calculating Var And Cvar In Excel In Under 9 Minutes Calculator Excel Risk Management

0 Response to "Calculate Value at Risk in R"

Post a Comment